2026 Ledger Data Breach: What Happened and How Scammers Are Targeting Ledger Users

18 February, 2026

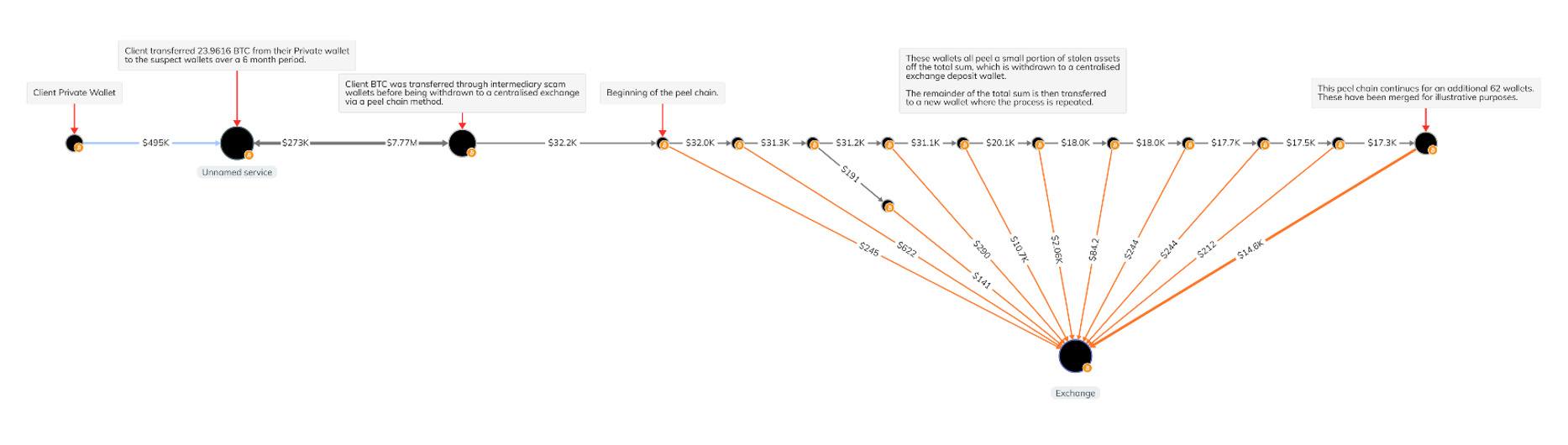

Cryptocurrency fraud often relies on complex transaction patterns designed to confuse victims, banks, and investigators alike. At Crypto Tracing Experts (CTE), we specialise in untangling these patterns and turning blockchain data into clear, usable evidence. This case study focuses on a tracing carried out for a client seeking to recover stolen cryptocurrency that had been deliberately fragmented using a technique known as a peel chain.

Why Peel Chains Are Used in Cryptocurrency Fraud

This trace was completed as part of a proof of loss investigation for a client who had been directed by fraudulent actors to transfer cryptocurrency. Once the funds were taken, the scammers began moving them through a peel chain to obscure their origin and complicate recovery efforts.

A peel chain is a laundering technique in which small amounts of cryptocurrency are repeatedly “peeled” away from a larger balance as it moves through a sequence of intermediary wallets. Each transaction leaves behind a slightly reduced amount, while the peeled funds are diverted elsewhere. Over time, this creates a web of transactions that fragments the stolen assets and makes it harder to follow them as a single trail.

Visualising the Trace: Understanding the Graph

The graph above shows a small portion of the overall tracing carried out in this case. It illustrates how the original funds were systematically broken down and distributed across multiple wallets through repeated peel transactions. While each individual transfer may appear insignificant in isolation, together they form a deliberate laundering strategy designed to evade detection and delay investigation.

By analysing transaction timing, wallet behaviour, and flow patterns, CTE was able to identify the peel chain structure and continue tracing the movement of funds beyond this point.

The Challenge: Tracing Fragmented Transactions

Peel chains present a particular challenge because they generate a high volume of low-value transactions, often spread across different wallets and platforms. Fraudsters rely on this complexity to overwhelm victims and discourage further action. In reality, these patterns are well understood within blockchain forensics and are a recognised indicator of laundering activity following a cryptocurrency scam.

Turning Complex Activity Into Evidence

Despite the deliberate obfuscation, CTE used advanced blockchain analysis tools and forensic techniques to follow the transaction trail and document the movement of stolen funds. The result was a clear, legal-ready proof of loss report that demonstrated how the cryptocurrency was taken, how it was laundered, and how the activity aligned with known fraud methodologies.

These reports are used by banks, solicitors, and other institutions to support complaints, investigations, and recovery efforts, helping victims move forward with confidence and clarity.

Supporting Recovery After Cryptocurrency Fraud

Cases involving peel chains show that complexity does not make tracing impossible. With specialist expertise and the right analytical approach, even heavily fragmented transaction patterns can be followed and explained. If you have been affected by a cryptocurrency scam, CTE can help trace stolen funds, produce robust proof of loss reporting, and support the next steps toward recovery. Enquire today to book an appointment with one of our experts.