2026 Ledger Data Breach: What Happened and How Scammers Are Targeting Ledger Users

18 February, 2026

Falling victim to a cryptocurrency scam is stressful, but the financial loss is often just the beginning. Banks and payment providers typically require proof that funds were genuinely lost to a scam before initiating recovery. Without professional support, this can be difficult to provide.

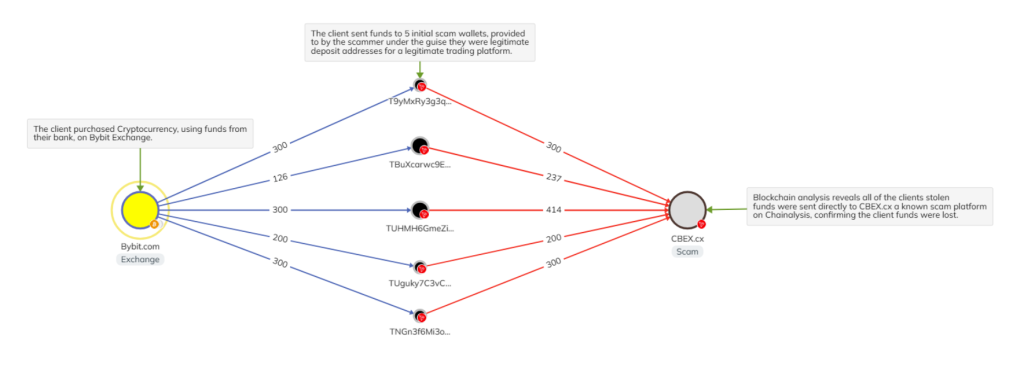

At Crypto Tracing Experts (CTE), we work closely with solicitor firms to produce proof of loss reports that clearly demonstrate, using blockchain evidence, where funds have been transferred and who controlled them. These reports are often a crucial step in helping banks recognise a scam and progress a recovery case.

Cryptocurrency is pseudonymous, not anonymous. While wallet addresses don’t display names, every transaction leaves a permanent trail on the blockchain. Advanced blockchain analysis allows our team to:

This level of visibility transforms a client’s personal account into verifiable, data-driven evidence that satisfies banks, regulators, and law enforcement.

Our reports are:

A recent case illustrates the impact: a client purchased cryptocurrency via a regulated exchange, then unknowingly sent it to scammers operating under the name Hyperverse. Using blockchain forensics, CTE traced the exact path of funds to Hyperverse-linked wallets. The proof of loss report allowed the client’s solicitors to provide the bank with solid evidence, enabling the recovery process to move forward.

Every investigation follows a transparent, methodical workflow:

While recovery cannot be guaranteed in every case, providing a verified, evidence-based report significantly increases the likelihood of a successful outcome.

At CTE, our mission is to bridge the gap between blockchain data and real-world recovery. We help victims, solicitor firms, and financial institutions prove the source of losses and support the recovery of stolen funds.

If you or your client has been affected by a crypto scam and requires a proof of loss report for your bank or legal case, contact CTE today for a confidential consultation.